Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Ripple (XRP) regained third place with a market cap, overtook Tether (USDT) in a move showing the renewed confidence of investors.

The rally indicates a large turning point on the token path to recovery, with the data on the chain add the weight of swing.

Although the whale activity seems to be cooling, a wave of reactivation of long-term wallets indicates deeper shifts-what suggests that this breakthrough can be more than short-term spikes.

XRP officially surpassed Tether to become the third largest currency of a market cap, which has not been held since the beginning of 2021.

Trading of $ 2,49 – briefly touches $ 2.60 – it seems that XRP is re -re -re -re -re -re -re -resting breakdown is supported by more than only in the market.

Source: Coinmarketcap

The proposed proposal of the Missouri Law (House Bill 594) could make the state first in the US in order to allow tax deductions to income from capital gains from digital assets, including XRP.

The number of XRP holders also increased by over 11% of 2025, while increasing the utility in the real world-for its new entry as a way of paying on the trade-in-dodly increases its narrative.

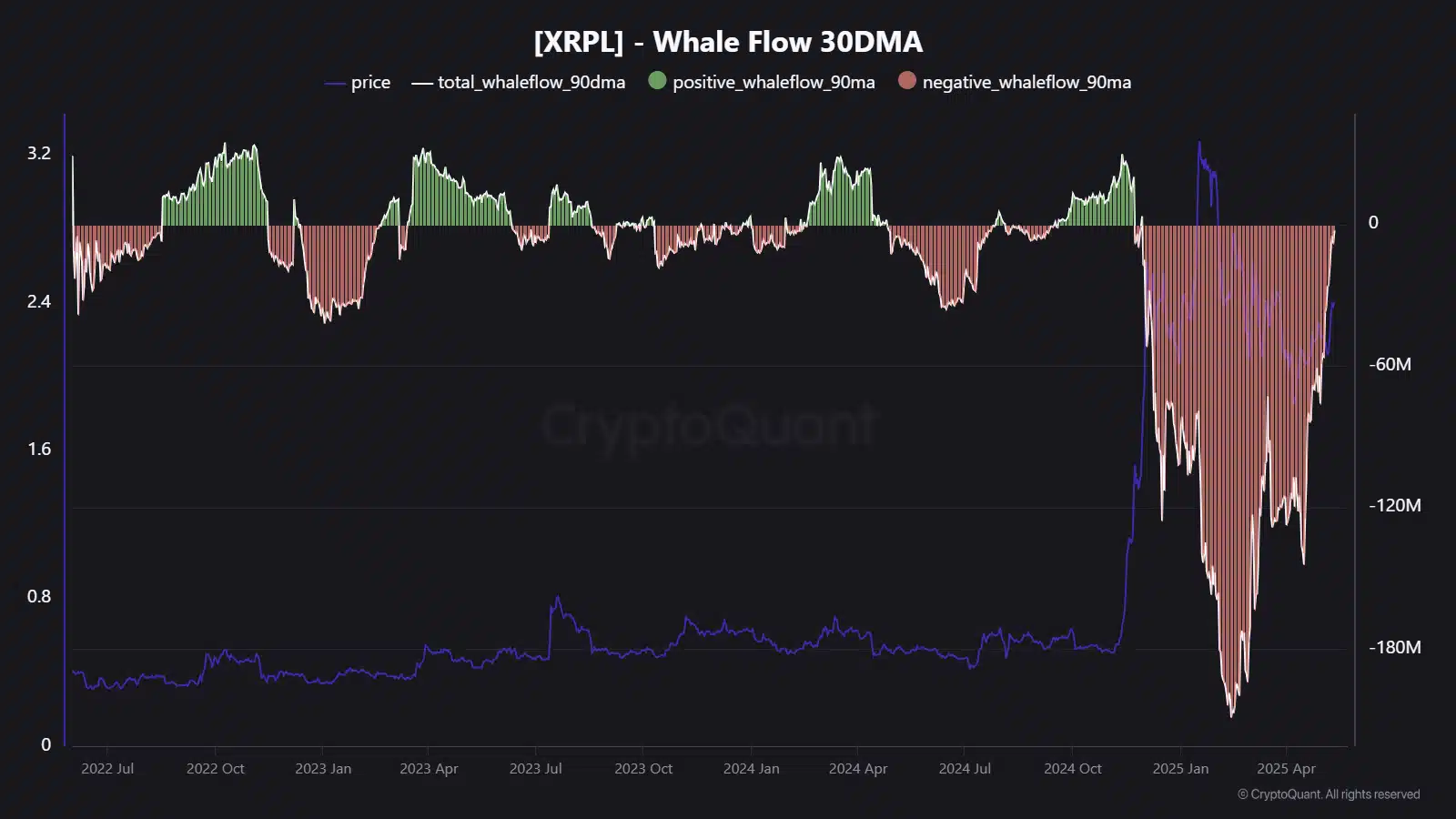

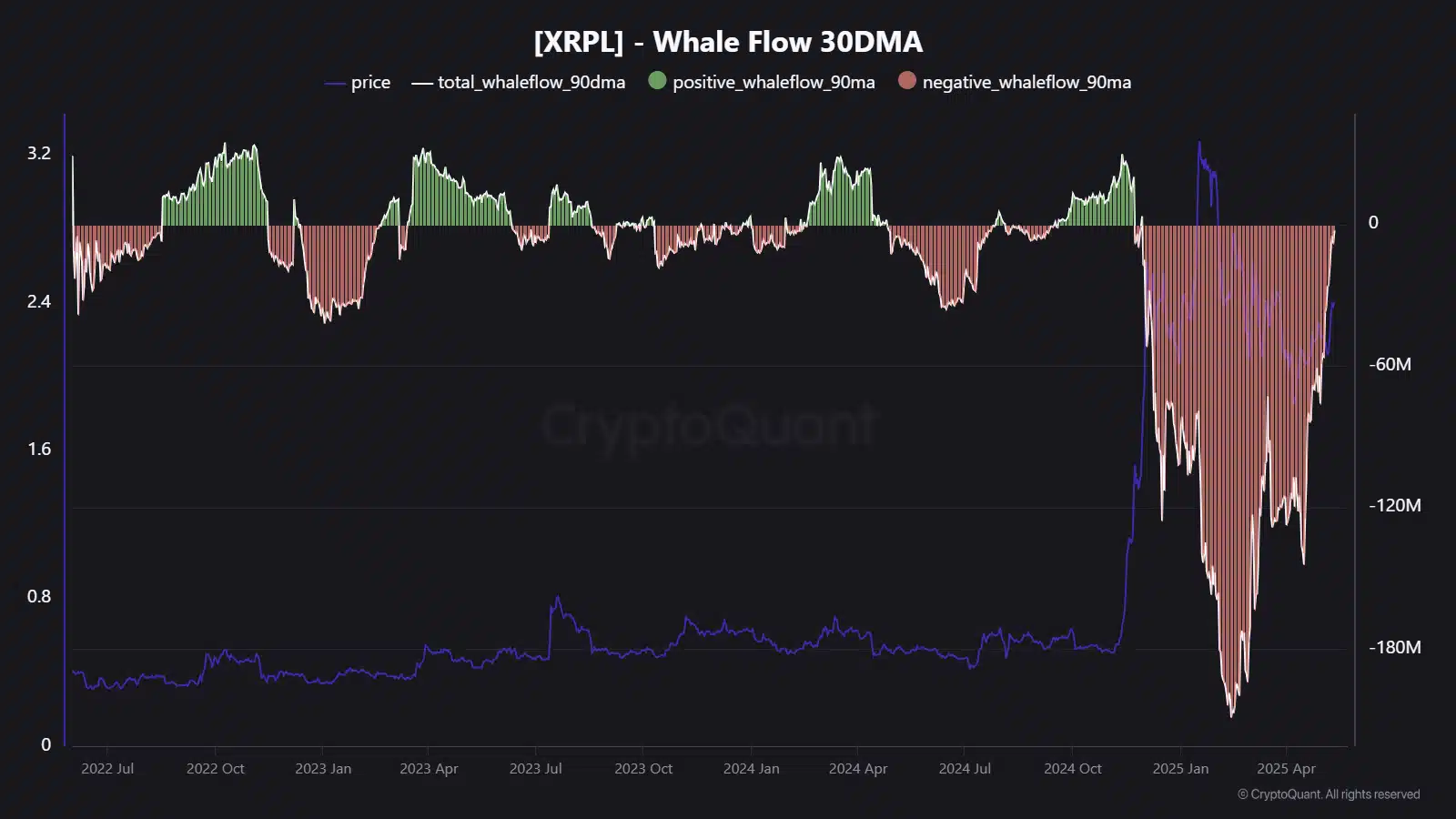

AND 30-day moving average The whale activity is now twisted up.

Source: Cryptoquant

The data on the chain shows that the total whale flow remains negative, but its steep decline has made it much easier since March 2025.

Historically speaking, such shifts preceded sustainable price recovery. The chart reflects this trend, with red strips softening and near neutral territory.

Although 30dma has yet to become green, slowing indicates the weakening of bear pressure.

This shift can be laid the foundation for a more stable base – and maybe the next leg.

XRP faced the months of permanent whale outflows, among the worst since the beginning of 2023. These outflows pressed the prices and feelings of investors.

However, the net flows are now stabilized, and the price table shows the renewed power – suggests cautious optimism.

Usually, when whale flow and starts recovering, it indicates the accumulation or building of the base.

In the past cycles, such as mid -2023, similar activity of whales was preceded by rallies for more weeks. If this power slowdown continues, this could signal a shift from volatility to consolidation.