Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

It’s quiet redirect.

While Bitcoin (BTC) hovering close to record heights, more than $ 1 billion in Stablecoini came to the binans quietly. Long -term owners pull back and risk, showing the decay of beliefs at current price levels.

Meanwhile, smaller investors enter aggressively, target reins and potentially maintain a rally.

Does the power dynamics run this rally massive?

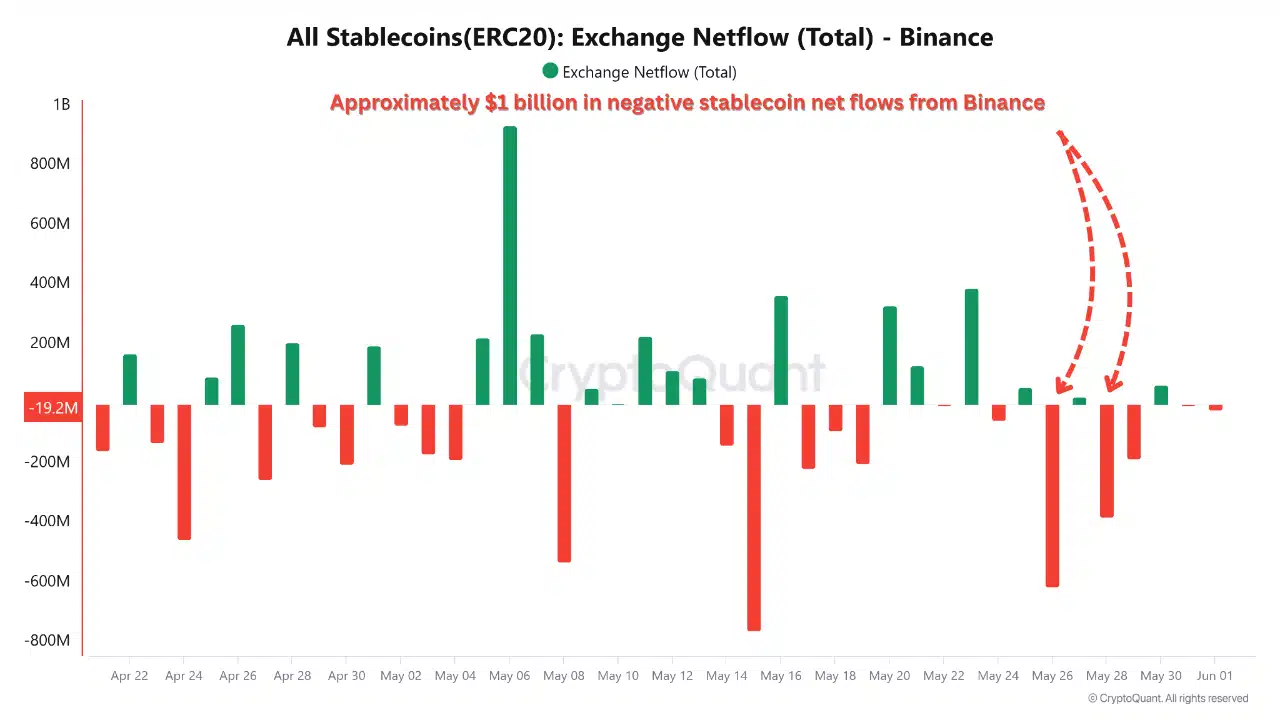

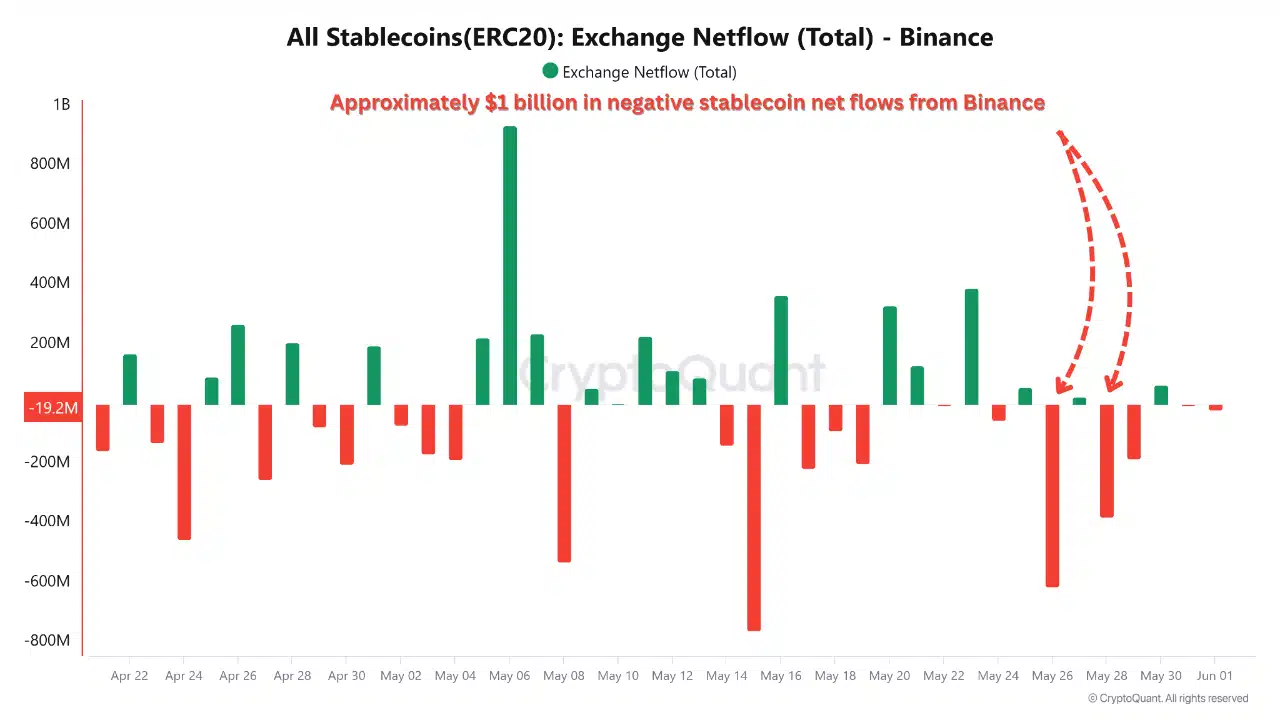

In May Binance taken Over billion dollars net outflow of Stablecoin, as shown in the lower chart, one of the most significant fatigue shifts in recent months.

Source: Cryptoquant

Stablecoin Netflowows are an indicator of purchasing powers on the exchange side, and withdrawing this size often indicates caution among larger players. While Bitcoin pushed the past $ 110,000, the capital base behind the set can be thinned out.

Precedents show that similar outflows or preceded refrigeration periods or pronounced moments of profit rotation.

Whether it is a signal of risk aversion or calculated pauses of institutional capital, one is clear: details of the gathering change.

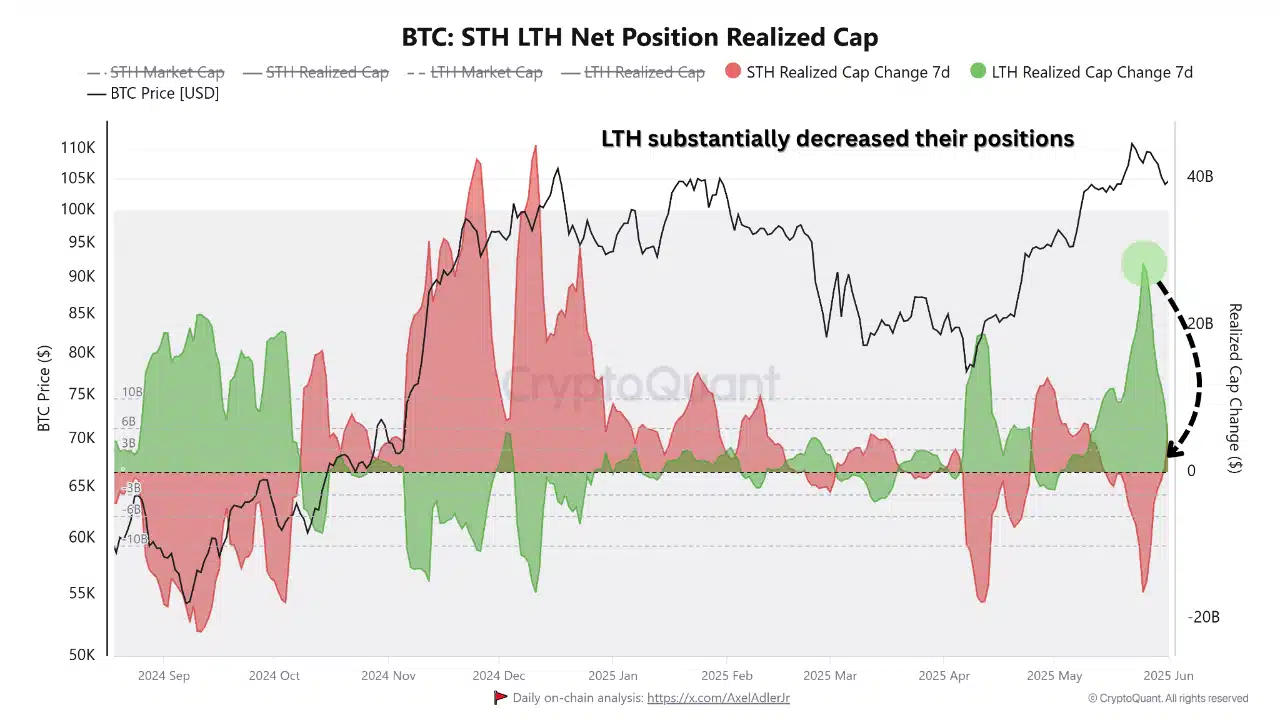

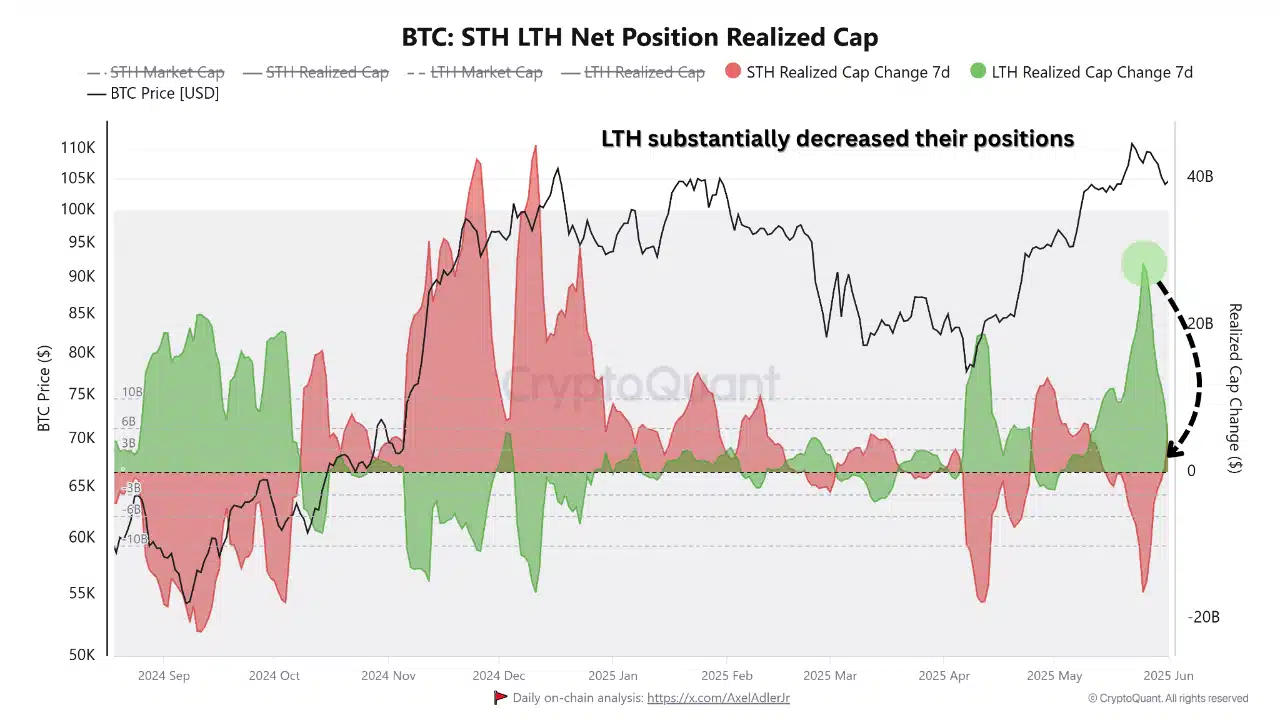

Bitcoin LTH LTH has sharply reduced their network, with $ 28 billion to only two billion dollars.

The green wave of accumulation has collapsed, replaced by a straight line, which often precedes distribution stages.

Source: Cryptoquant

Such dramatic shifts usually predicted local peaks or periods of movement of the side path, especially when the short -term owners fail to pick up. This is a smart money for risk!

It seems that some of the strongest hands on the market are no longer held firmly.

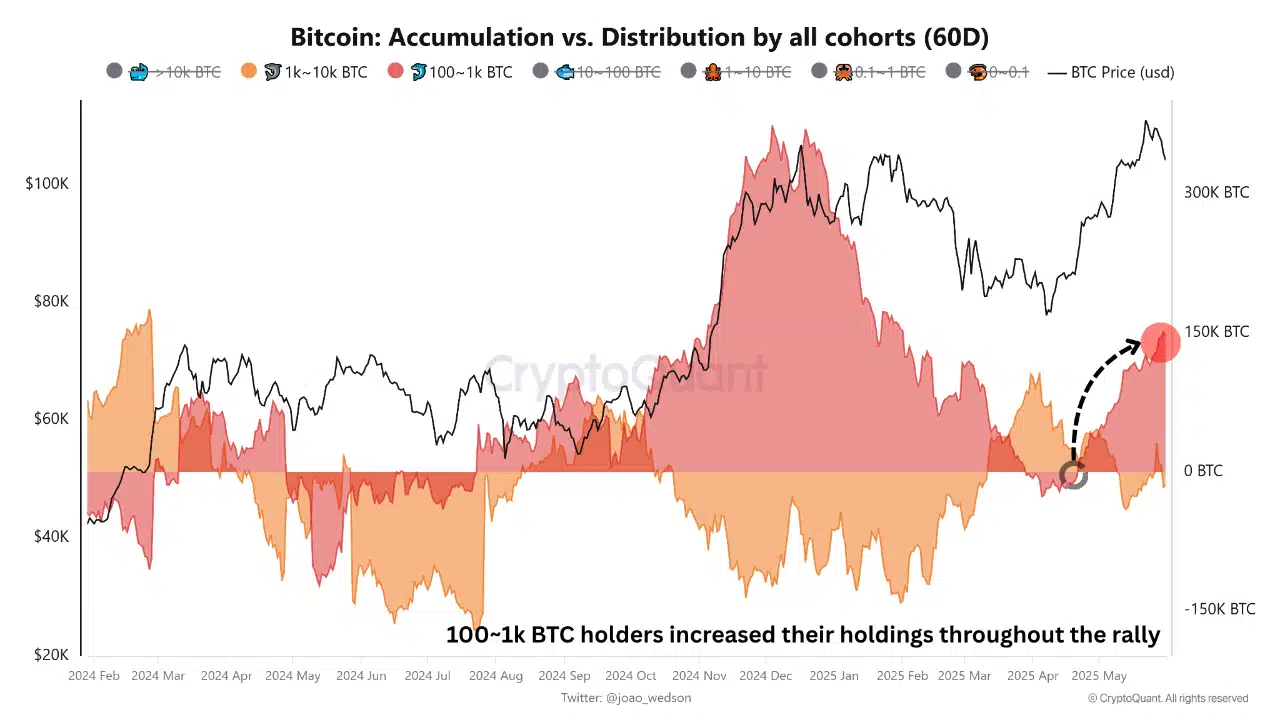

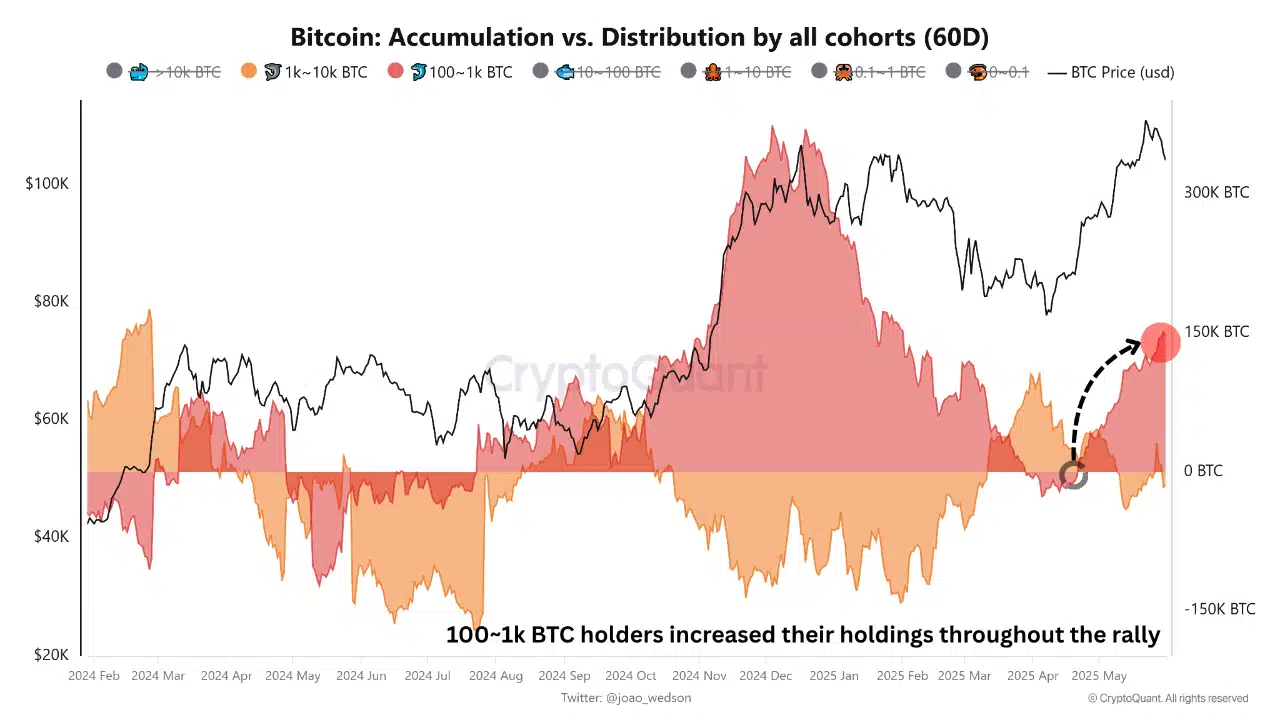

During Bitcoin’s climb from $ 81,000 to $ 110,000, the 1k-10k BTC wallets were systematically distributed, showing profit at the top.

Source: Cryptoquant

In contrast, wAleti holding 100-1K BTC have become net batteries, adding strength to the set.

Recent data reveal a change: the owners of institutional sizes are sold, while smaller, retail wallets continue to buy. This indicates that the rally is now guided by retail, which indicates a key turning point in the market dynamics.

As the belt of the whale weakens, retail investors now bear responsibility for maintenance of cultivation. But when the institutions withdraw, does the market enter the vulnerable phase?

The baton has passed – now is the rally of retail to wear or loss.