Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Bitcoin (BTC) shows signs of potential displacement, as recent data emphasizes a significant increase in long positions accumulated between the range of 101,000 $ 106K.

Although the price rotation could be initiated by liquidation, indicators on the chain discover the fresh accumulation of retail investors and large owners.

This growing confidence suggests that the market can enter the early stages of the bull turn.

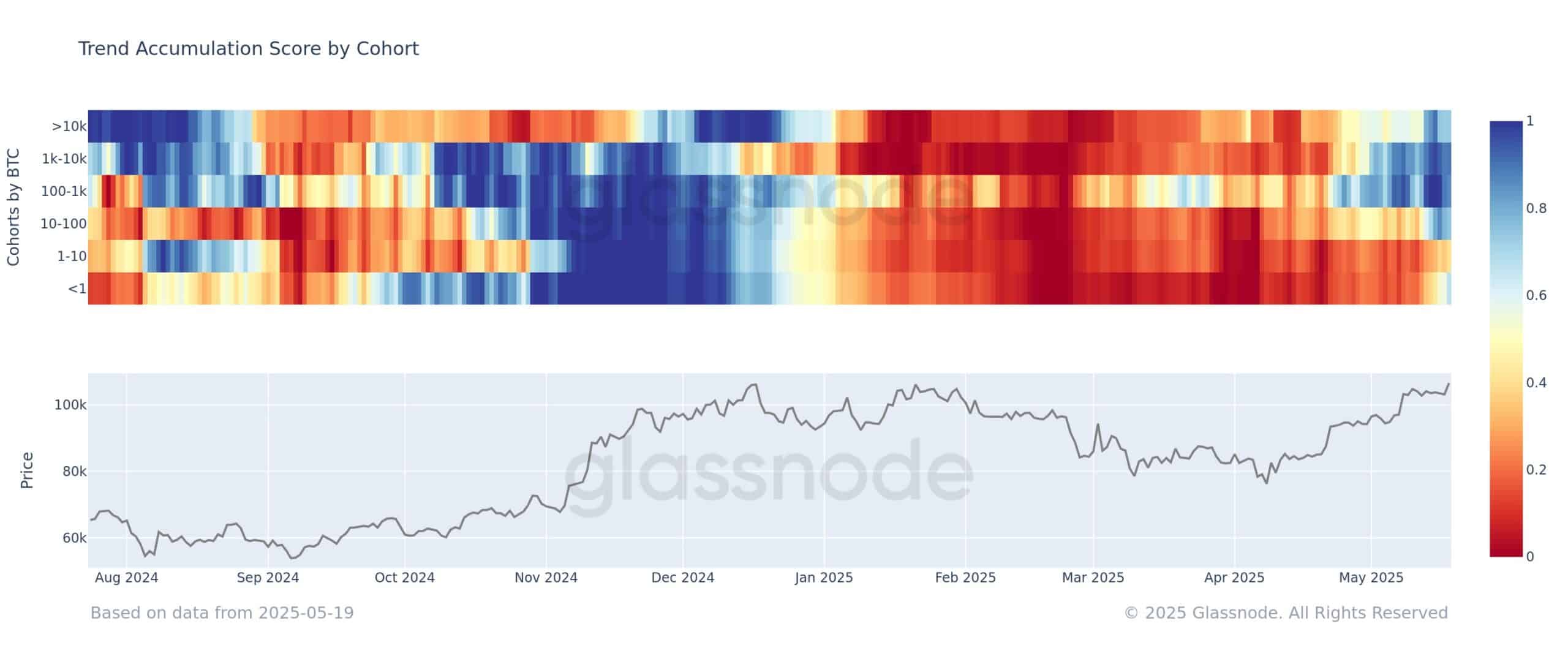

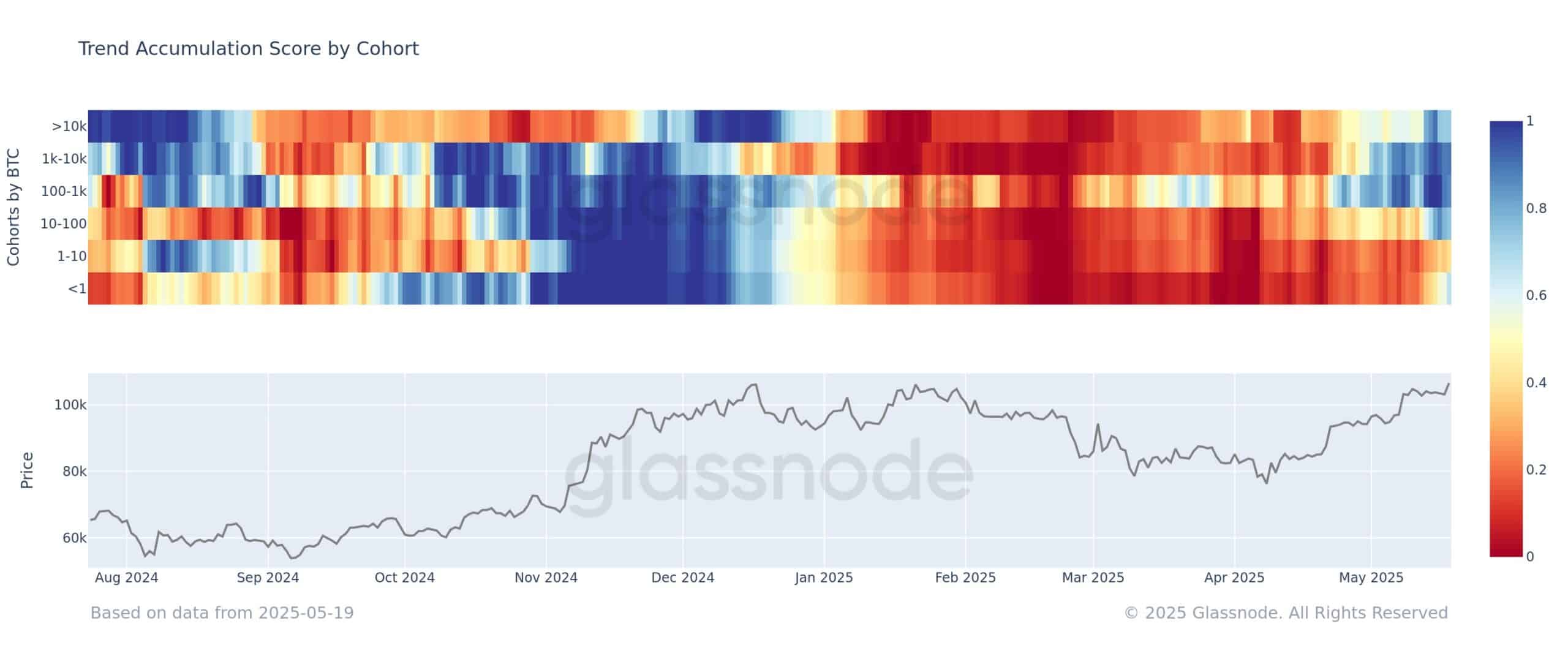

Recent data from Glasnod discovered A clear change in market behavior, with accumulation trends that now extend almost all the sizes of wallets.

Smaller holders with less than 1 BTC have revealed their previous distribution trend and are now gathering slightly, reflected in the accumulation assessment of approximately 0.55.

Source: Grenede

Meanwhile, larger cohorts of wallets – which deal between 100-1,000 BTC and 1,000-10,000 BTC – show even stronger accumulation trends.

The only segment that is still in the net distribution mode is a range of 1–10 BTC, which strengthens the broader re -re -re -rest on Bitcoin’s price.

A significant long position concentration between $ 101 and $ 106,000 has formed a high risk liquidity zone.

According to Alpctal dataThis setup increases the vulnerability of the market to sharp liquidation cascades, especially if Bitcoin -that price drops below the threshold of $ 100,000.

Source: Alphactal

In contrast, the potential for short liquidation on the upwards moves seems relatively limited. With a long exposure in this zone, all signs of weakness in BTC could quickly be revealed in forced sale and increased volatility.

As seen on the daily chart, BTC showed signs of exhaustion below the $ 106,000 level. Despite having briefly touched $ 106,813, BTC failed to close above this key resistance, sliding a little at $ 105,504 at the time of the press.

Source: TraringView

At the time of writing, the RSI was 69.42 – hovering just below the over -excessive threshold – a sign of the decay of the bull momentum.

In the meantime, Obl was flattened around -86.6k, hint of a pause of pressure on the Cup.

If Bitcoin can maintain support over $ 105,000, a break toward $ 110,000 remains convincing. However, a fall below $ 101,000 could start long liquidation and escalate instability.