Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

January showed for many crypto assets, with Bitcoin (BTC), which increases against the US dollar from the beginning of 2025. Years. However, several other digital currencies recorded quadruple and triple digits, while numerous coins experienced losses ranging from 55% to almost 80% in the last month.

At the time for the press, at the beginning of 2025. February, the global market capitalization of the crypto spic is $ 3.36 million – remains above the trillion of $ 3.26 recorded 1. January, Bitcoin (BTC) as much as 2.3% Even Ethereum (Eth ) in the same period reduced more than 10%.

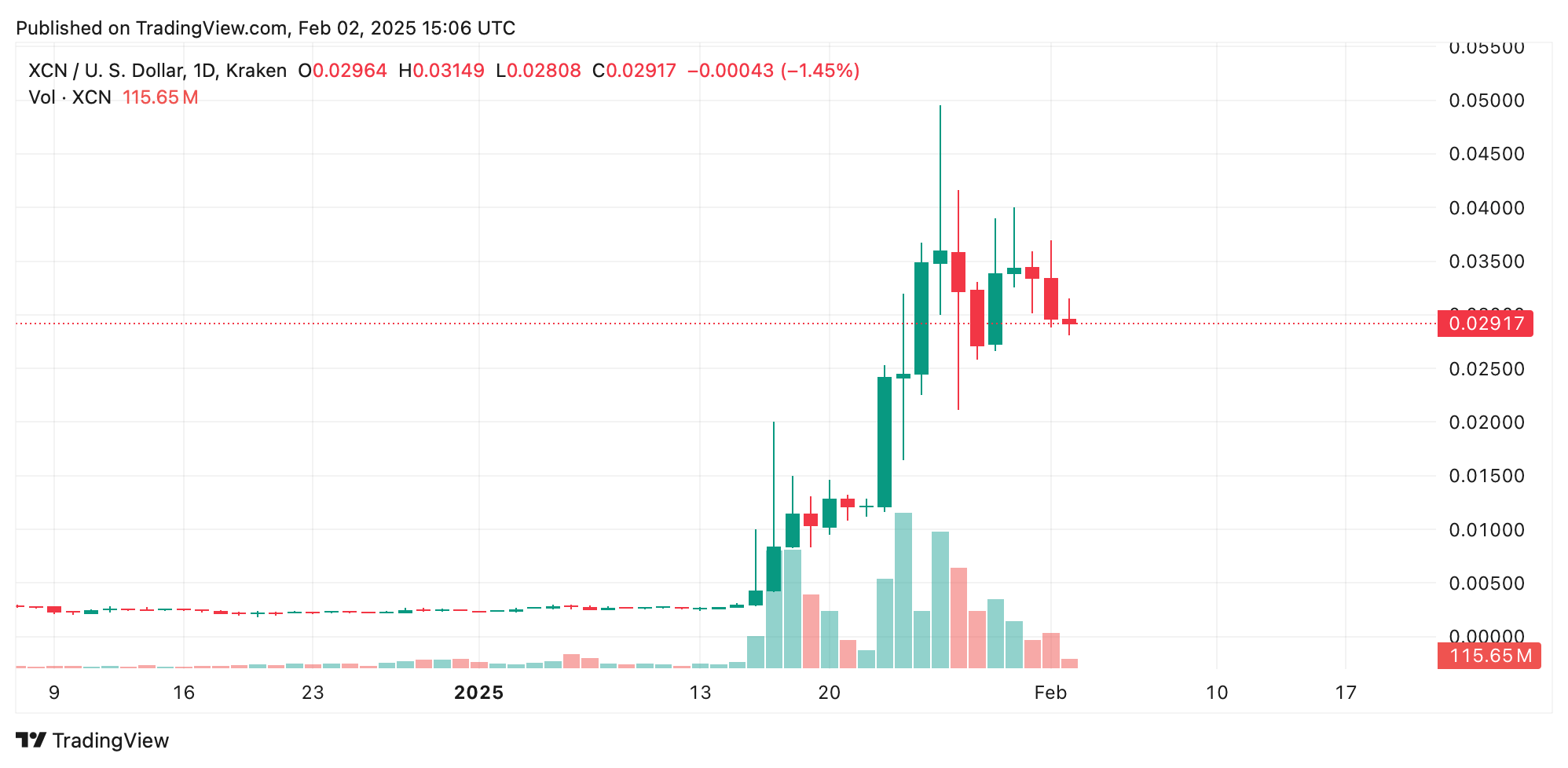

XCN / USD Via Kraken 2, 2025. February 2025.

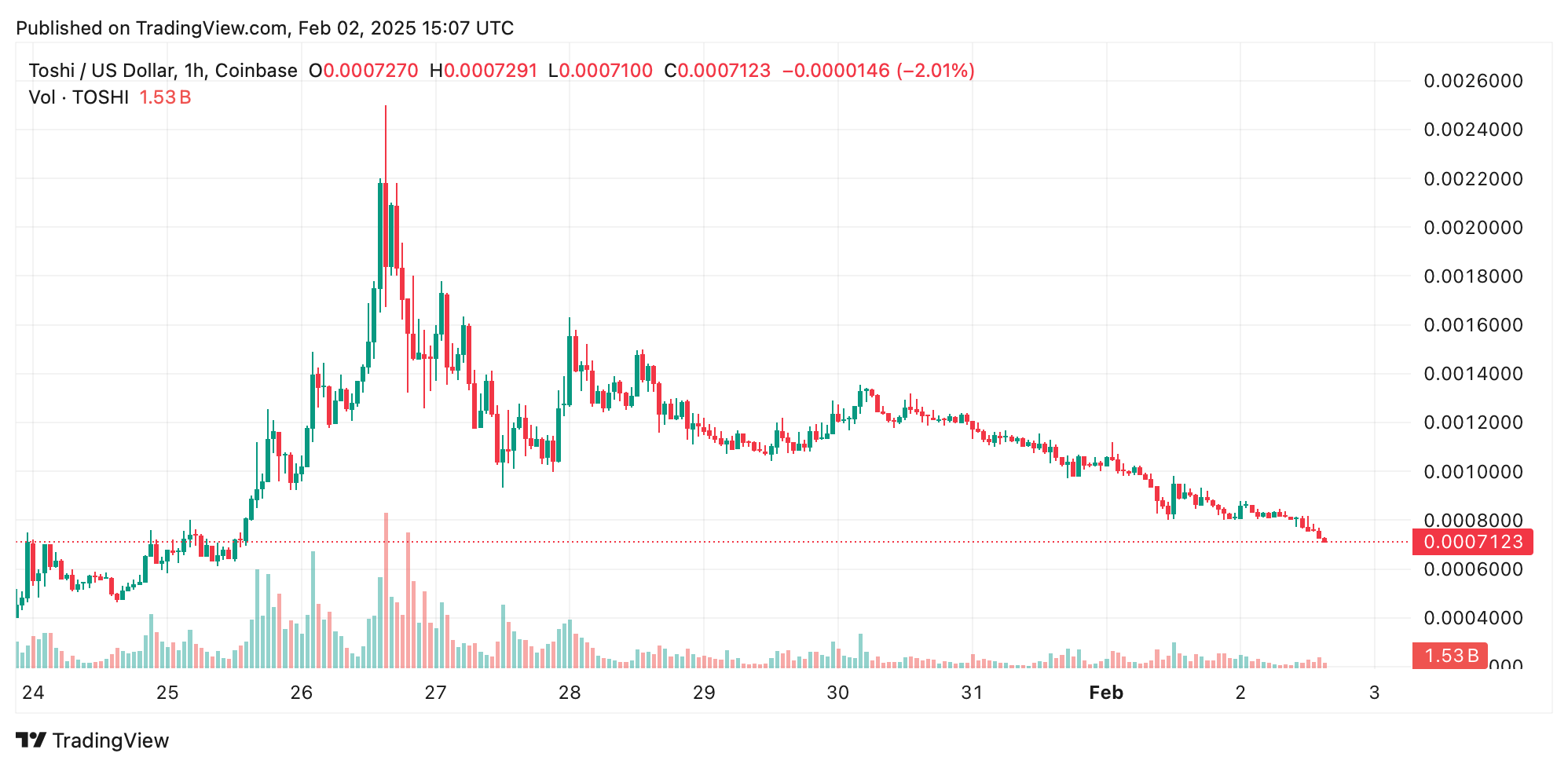

The top performer of this last month was onyxcoin (XCN), which jumped to 1.098% compared to the green blow. Then Toshi (Toshi), which rose by 443% of the beginning of the year, and Ultimaecosystem (Ultima) was appreciated by 97.6% in value.

Toshi / USD over coinbase 2. February 2025.

Vethor (VTHO) was managed by climbing 86.1%, and the Alhemy salary (ACH) is 66.95%. Other significant winners include OM, increased by 31.47%, GT, which rose 24.60%, and KCS increased by 23.82% compared to the US dollar.

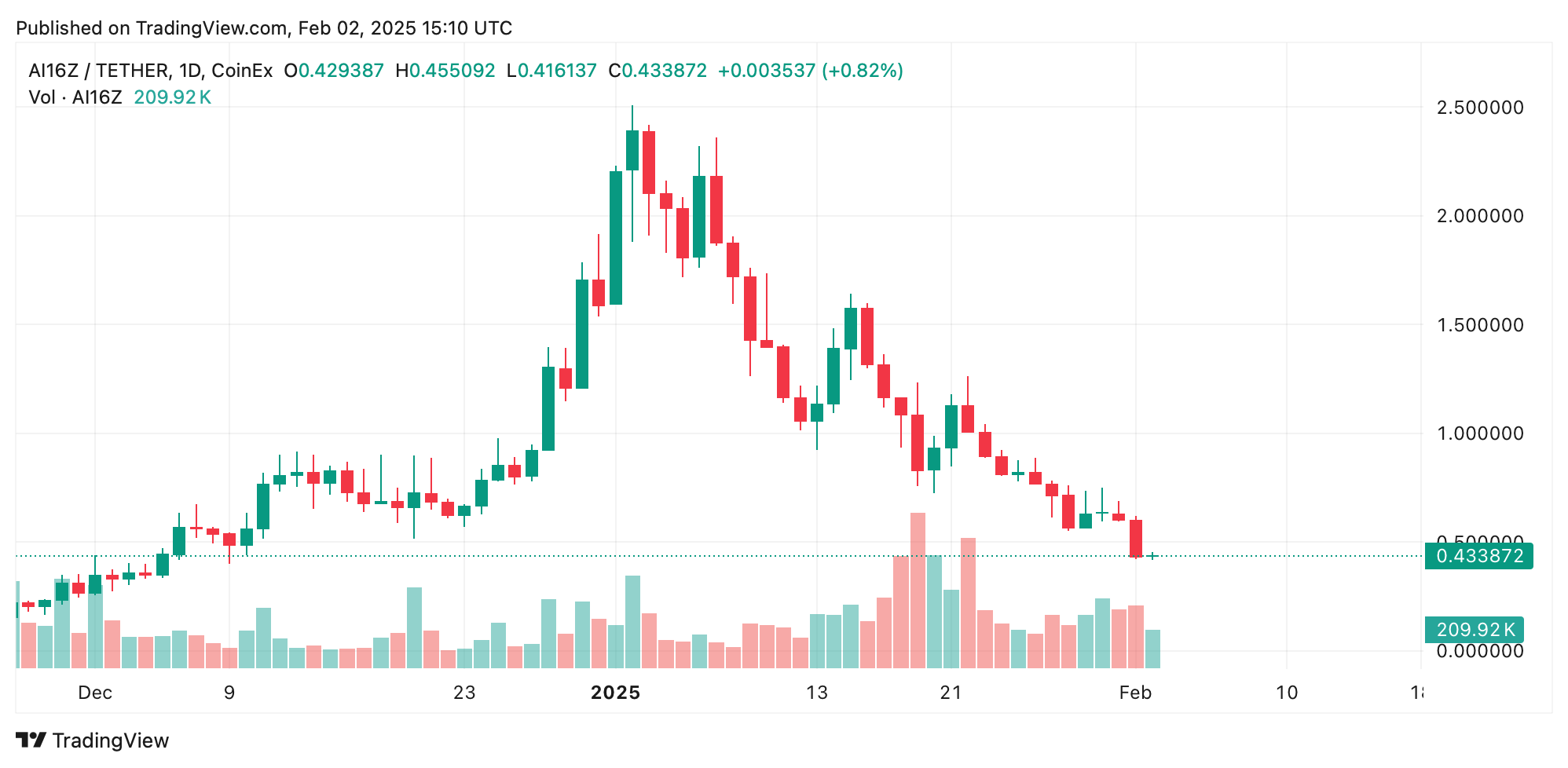

However, January proved less favorable for many coins, which followed a distinctly different path. For example, the most significant declension of the month belongs to A16Z, artificial intelligence (AI) Agent Meme Meme, which lost 78.48% in January.

A16Z / USD or USD Via Koinex on February. 2, 2025.

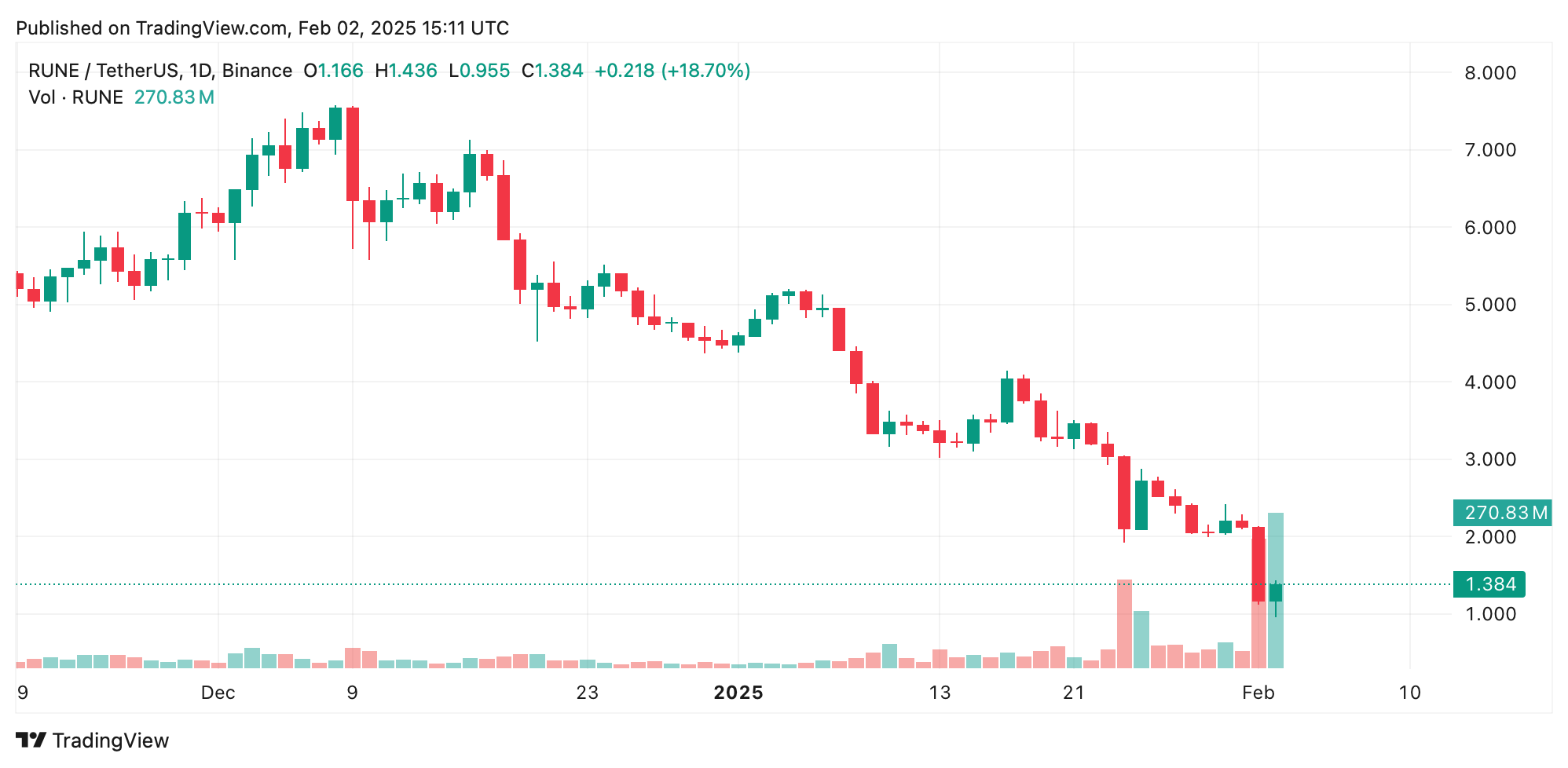

Thorchain (Runa) experienced a stunning 71.67% decline in the past month, and the virtual protocol (virtual) fell by 61.93%. The Peng was reduced by 60.01%, Fartcoin kicked 57.48%, my row was 52.92%, Brett lost 51.38%, and the dog fell 50.11%.

Runei / USD using Binance 2. February 2025.

And WIF is 48.50% in January in January, placed just under the dog losses. A significant part of these stalls arose exclusively from the sector of the speculative mem of the coin.

Currently, market participants appear ready to navigate untreated territories, encouraging and optimism and caution. Such oscillations remind the stakeholders to remain developing the experiment for several sets and types of crypto property.

It is evident that in the entire market crypto, volatility indelably marked the beginning of 2025. It will be interesting to see if this trend will continue to define the year.